Before you set up a new irrevocable trust, you need to understand what taxes you and any future beneficiaries may need to pay. When it comes to taxes, irrevocable trusts have different rules and limitations compared to revocable trusts.

Fortunately, you can often use irrevocable trusts – especially when set up by specialists like Dominion – to minimize or avoid certain types of taxes entirely. Let’s dive deeper.

What is an Irrevocable Trust?

Simply put, an irrevocable trust is a fiduciary arrangement that can’t be changed or altered by the grantor or beneficiaries after it is set up. It’s best contrasted with a revocable trust (the most common trust instrument), which can be altered if you desire.

Imagine that you set up a trust for estate planning purposes. If your trust is revocable, that means you can file paperwork with the courts to alter the trust, its conditions, the beneficiaries, or something else.

You can’t do the same thing with an irrevocable trust. That’s part of the point – if the trust is irrevocable, you can never be compelled by a court to change it or its distribution rules because it’s unchangeable according to the law.

Add offshore jurisdictions to the mix, and an irrevocable asset protection trust is the most durable instrument you can use for wealth preservation and protection as a high-net-worth individual.

Aside from asset protection, however, irrevocable trusts are oftentimes used by those with a lot of money to protect and pass down thanks to their tax rules.

How is an Irrevocable Trust Taxed?

The way your irrevocable trust will be taxed is heavily dependent on whether or not it is based in the US or some other offshore jurisdiction. An offshore irrevocable trust is not illegal in any way – it just means the trust is based in a country other than your own. Thus, it’s subject to different tax rules and frameworks.

US Irrevocable Trusts

With revocable trusts, the IRS treats all the property contained in the trust as though it is the grantor’s property when calculating income taxes. As a result, the grantor has to report the property in the trust on his or her tax forms with their own Social Security numbers.

With irrevocable trusts, it’s different. The IRS instead assigns a separate tax ID number to each irrevocable trust. The property in the irrevocable trust belongs solely to the trust, and the irrevocable trust itself is a separate tax entity for all intents and purposes.

This also means the irrevocable trust (or, more specifically, the trustee managing the trust) has to file its own tax return.

Grantor Irrevocable Trusts

A grantor trust is one in which the creator of the trust has significant rights or benefits in the trust. For example, if a grantor sets up an irrevocable trust and is also the trustee, they retain overall control over the vehicle and the assets contained within.

Under this setup, the grantor is responsible for filing a separate tax return for their irrevocable trust. Again, they don’t have to combine their income with that of the trust for income tax purposes. But they’re responsible for making sure their books are accurate.

Non-Grantor Irrevocable Trusts

A non-grantor irrevocable trust is one where the grantor does not retain any control responsibilities. In other words, the grantor isn't the same entity as the trustee. They instead entrust that duty to a knowledgeable third party.

Because of this, the trustee is responsible for setting up the tax form for the irrevocable trust every year, as well as reporting its income accurately.

Beneficiary Taxes

If you set up an irrevocable trust, the trust itself isn’t the only entity with a tax burden. Any trust beneficiaries also need to consider taxes.

However, whether or not an irrevocable trust beneficiary has to pay taxes depends on:

- The type of irrevocable trust

- How the distribution money is given to beneficiaries

Let’s touch on the second point first. Whenever a beneficiary receives a distribution from an irrevocable trust’s principal balance, the beneficiary doesn’t have to pay any taxes on that distribution. The trust doesn’t have to pay taxes on that distribution either.

The IRS automatically assumes the money was taxed before it was placed in the trust.

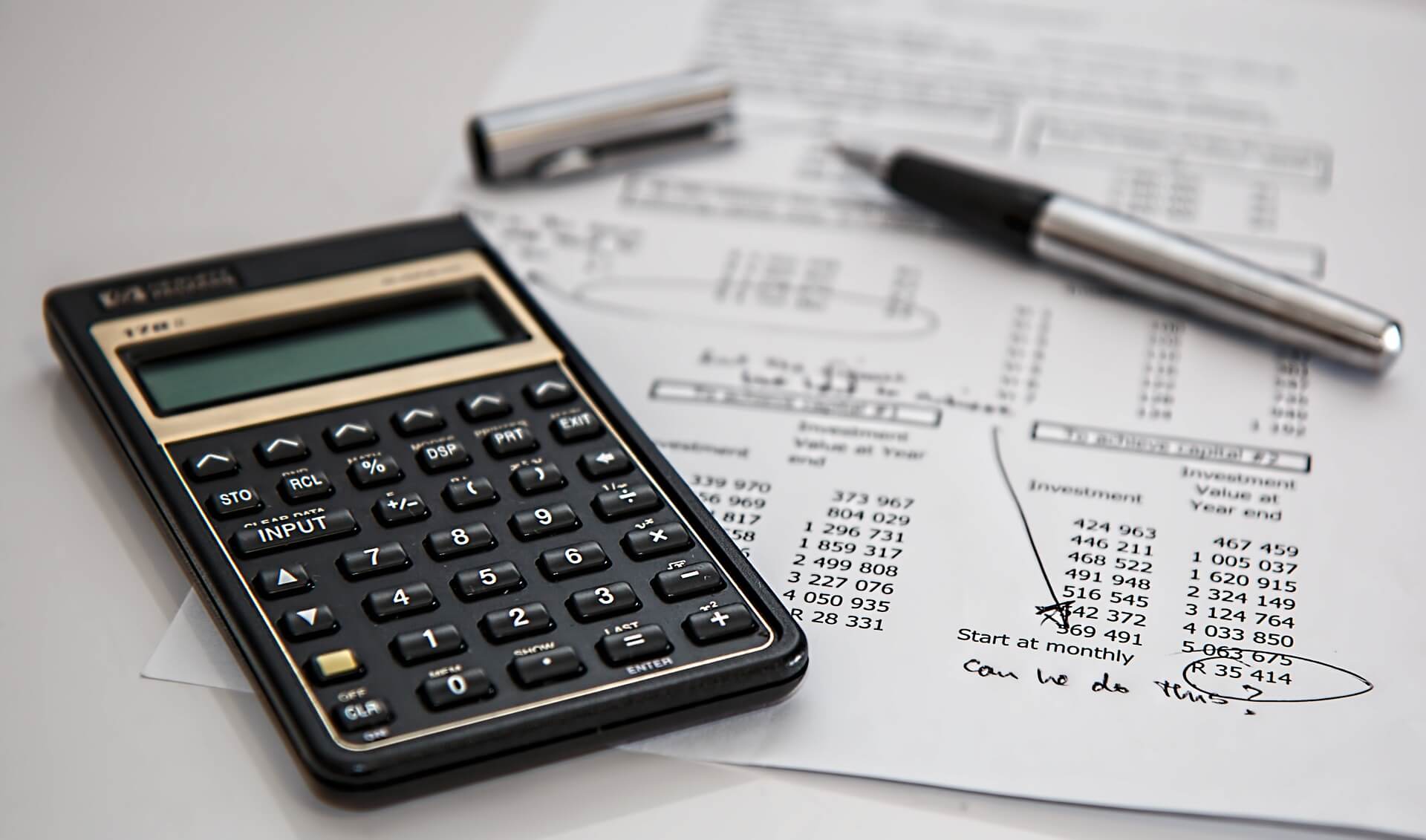

But if the beneficiary receives money that derives from interest from the trust’s principal assets, the interest income is taxable. Here’s an extremely simple example with basic math:

- A grantor places $1000 worth of assets into an irrevocable trust. The assets are not invested to generate any income or interest

- The beneficiary receives the $1000 in assets. The beneficiary doesn’t have to pay taxes

- Alternatively, a grantor places $1000 worth of assets into an irrevocable trust. The assets are invested and start to generate interest

- The beneficiary receives $1200 in assets and interest. The beneficiary has to pay taxes on the $200 extra

In addition, different types of irrevocable trusts may have different tax laws and exemptions. When you work with the experts at Dominion, we’ll recommend setting up one trust or another based on these tax rules to maximize your income and minimize the estate and other taxes your beneficiaries will eventually need to pay.

Estate Taxes

When you store property in an irrevocable trust in the US, and that property is then inherited by beneficiaries after your death, that property doesn't go through the probate process.

This is why so many high-net-worth individuals use irrevocable trusts for estate planning purposes; you can minimize or avoid estate taxes entirely.

The same is true for gift taxes to a limited extent. As of 2023, you can make up to $17,000 worth of contributions to an irrevocable trust for gifting purposes without having to pay taxes on that income.

Irrevocable Trusts and Capital Gains Taxes

Capital gains include any money earned on an asset between its purchase and when it was sold. For instance, if you buy a house for $100,000, then sell it a few years later for $150,000, your capital gain is $50,000.

With irrevocable trusts, the capital gains taxes only apply to any capital assets like stocks, real estate jewelry, bonds, collectibles, and jewelry. Thus, putting certain assets into your irrevocable trust could allow them to avoid capital gains taxes altogether.

Furthermore, capital gains taxes only apply to profits from sales of assets held by the irrevocable trust for more than one year (these are called long-term capital gains).

Once more, working with a knowledgeable financial advisor can help you make the most of these tax laws depending on what assets you store in your US irrevocable trust.

Offshore Irrevocable Trusts

The situation may be completely different for offshore irrevocable trusts, like the offshore asset protection trusts we set up at Dominion.

By design, offshore trusts are beholden to different rules and tax frameworks compared to domestic trusts. All of the above information may not apply to your offshore irrevocable trust since all those laws only apply to instruments set up in the US.

This is one of the big elements that make offshore asset protection trusts so valuable for high-net-worth individuals. When you store your money and assets in an offshore trust, you can potentially avoid or minimize the high taxes that are prevalent in US trusts.

At the same time, you’ll secure your assets against US creditors, courts, ex-spouses, former business partners, and anyone else who may wish to target your wealth.

Placing assets in an offshore irrevocable trust effectively eliminates your ownership of those assets. Then, even if you are successfully sued, you can’t be forced to give up those assets (since you don’t own them!).

So long as you have a trustworthy entity overseeing the trust as a trustee, you can continue your business or other operations and rest assured you’ll be able to receive distributions (or your beneficiaries will, depending on your goals).

Because different countries have different rules, Dominion studies dozens of different jurisdictions and foreign countries where you can set up the perfect trust for your estate.

Don't assume that one jurisdiction is right for you just because you've heard of it from pop culture or because you have a friend who set up a trust there. Each individual's asset protection strategy must be unique and custom-tailored to ensure protection.

Contact Dominion Today to Learn More

Overall, irrevocable trust taxes and rules can be tough to keep wrapped around your head, especially if you set up an offshore irrevocable trust for asset protection purposes. Fortunately, you won’t need to keep all this information in mind by yourself.

Dominion’s financial and legal specialists are ready to help you set up the ideal irrevocable trust for asset protection and estate management going forward.

More than that, we’ll ensure that your irrevocable trust is set up in the right jurisdiction to minimize taxes and maximize wealth generation and preservation.

That's the kind of service you can get as a high-net-worth professional. You've already earned your money – now you should use it to keep it safe from creditors and more with Dominion. Contact us today.

.jpg)