The point of an irrevocable trust is that it can’t be changed. As opposed to traditional or revocable trusts, once you sign on the dotted line for an irrevocable trust, it might as well be set in stone.

However, life can be complicated and you might run into unexpected situations where you're better off without your irrevocable trust holding your valuable assets. In those situations, can you terminate an irrevocable trust? That depends, so let’s break this down in more detail.

Conditions Where a Trust is Terminated

A trust is a versatile fiduciary arrangement where a grantor gives up ownership and/or control of assets to a third party called the trustee. In doing this, the grantor gets a variety of legal protections and ensures that key assets, like real estate or liquid capital, are handled, managed, and distributed according to their wishes, even if they aren’t able to voice those wishes.

Sometimes, however, a trust isn’t necessary any longer. There are situations where a trust can be terminated due to the wishes of the grantor or through other circumstances.

The Trust Expires

Firstly, a trust is terminated whenever it expires naturally. Many revocable and irrevocable trusts have terms baked into their founding documents that state they will dissolve – and their assets distributed or otherwise put elsewhere – upon a certain date or upon the fulfillment of certain conditions.

For instance, say you have a basic testamentary trust. The testamentary trust comes into effect when the grantor dies and their will is read. Upon the reading of the will, the testamentary trust serves its purpose of holding assets until they are distributed to beneficiaries, then dissolves immediately after.

The Trust’s Assets Are Completely Distributed

Alternatively, a trust may terminate or stop existing if all of its assets are distributed. For instance, if you set up a trust to manage your estate, but your beneficiaries have free reign to take assets from the trust by asking the trustee, the trust might not serve its purpose if the nest egg or savings within are prematurely depleted.

The Trust is Revoked

Lastly, a trust could be terminated if it is revoked by the grantor and/or certain beneficiaries. For most revocable trusts, the grantor can choose to terminate the trust whenever they like.

As an example, maybe they decide that they don't want to give certain assets to one grandchild, so they terminate the original trust and draw up a new one for a different grandchild's benefit. However, irrevocable trusts can’t be revoked so easily (though they can be revoked and modified in some situations).

Can an Irrevocable Trust Be Terminated in the Same Ways?

Sometimes. For example, an irrevocable trust can certainly be terminated if it expires according to the founding documents or the wishes of the grantor.

Let’s take another look at a common irrevocable family estate planning trust. A grantor forms the trust to ensure that assets and real estate are distributed properly and to the right people, plus stops the family from having to sit through probate.

Once the family planning trust fulfills its purpose, and all the relevant assets are distributed, it is terminated or expires and the trustee is released from their fiduciary duty. Similarly, an irrevocable trust could be terminated if all the assets inside are taken out (though this, of course, requires that the trust have terms that allow the assets to be removed prematurely or by certain individuals).

What if You Want to Terminate the Trust Ahead of Schedule?

So, what about the third condition – a trust being terminated voluntarily? This is where things get tricky for irrevocable trusts.

It’s only possible to modify any irrevocable trust if the grantor and any beneficiaries collectively agree that:

- The trust needs to be modified or changed for some reason

- The change or modification adheres to the original will or intent of the grantor

Then, depending on your jurisdiction, you may also need to petition a court and get the court to agree to a modification of the irrevocable trust for it all to work out.

Since terminating an irrevocable trust is a type of modification, this is an unavoidable process. Say that you have set up an irrevocable trust with 12 different beneficiaries, including yourself. It might be a logistical nightmare to try to track all of those people down and get them all to agree to terminate or change the trust.

Still, it is possible on paper to terminate your irrevocable trust early or ahead of schedule. However, it’s usually in your best interest to simply draft the trust such that you don’t need to terminate it later.

Decanting a Trust

Certain US states and other jurisdictions allow for a process called “decanting.” Taking its name from decanting wine or liquor, when you decant a trust, you “pour” the assets from the trust into a new trust arrangement.

Say that you have an irrevocable trust that doesn’t meet your needs any longer. However, you still want the assets within to be saved within a trust. To accomplish this, you’ll first set up the secondary trust, then decant the assets in your original irrevocable trust and place those assets in the secondary trust.

Again, this is only possible in certain jurisdictions. Furthermore, your irrevocable trust needs to have terms or loopholes within its drafting documents that state this is possible. If your irrevocable trust has a specific clause saying that decanting is not allowed, you’re out of luck.

Why Are Irrevocable Trusts So Hard to Terminate?

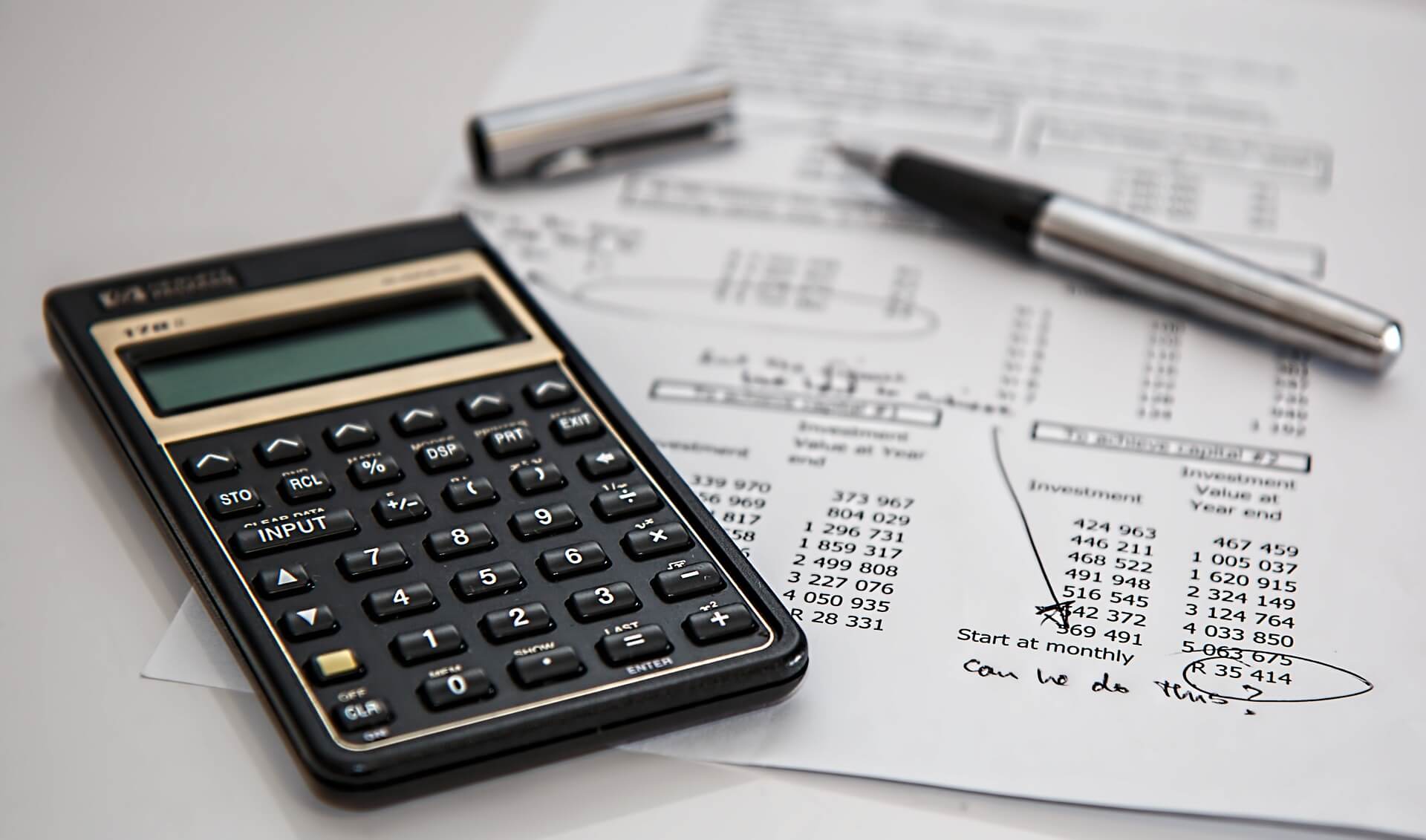

If irrevocable trusts were easy to terminate or modify, it would partially degrade the protections they provide to high-net-worth individuals.

The primary value that an irrevocable trust lends to high-net-worth people is durability. Simply put, if you can't change your irrevocable trust, a court can’t order you to do it. That sounds circular, but imagine a circumstance where you are found liable for millions of dollars in damages.

The court and plaintiff want as much money as they can ring out of you as possible. If most of your money is in an irrevocable trust, the court can’t tell you to modify the terms of the trust to accelerate your distribution schedule, to take out all the assets and give them to the plaintiff, or something else.

The unchangeability of the trust is its primary strength. This is also a big strength for other trusts, like estate planning trusts. If the trust can be changed by beneficiaries, like greedy grandchildren, the assets within will stay solvent and valuable for a long time to come, and those assets would also be extra protected against creditors and lawsuits.

Contact Dominion to Learn More

To recap, it is possible to terminate an irrevocable trust, but if you set up your trust properly and have a well-thought-out asset defense strategy, you shouldn't need to. That's another hit of the value that Dominion can provide high-net-worth individuals like you.

When you work with us, we’ll help you set up a durable, irrevocable asset protection trust in an offshore jurisdiction. By doing this, we’ll ensure that your most valuable assets can’t be taken by creditors, lawsuits, ex-spouses, or other possible opponents. We’ll also set up your trust such that you can receive distributions or access to other assets when it’s appropriate.

The same is true for any other beneficiaries you might have, like your children. In any case, it’s unlikely you’ll need to terminate your irrevocable trust if you work with Dominion. Get in touch with us today to learn the details.

.jpg)