Trusts aren’t only useful for distributing assets after your death. In many cases, it’s wise to set up a trust you can use and take advantage of while you’re still alive, whether that’s for protecting valuable assets or setting yourself up for a comfortable retirement.

That’s why you might need an irrevocable living trust. Let’s go over what an irrevocable living trust is, how it works, and why it's a good option for high-net-worth entrepreneurs, business executives, and medical professionals for wealth protection and preservation.

What’s a Living Trust?

A living trust is simply a fiduciary arrangement that is established by the grantor (also called the settlor) while the grantor is still alive. In many cases, a living trust is also used by the grantor to access distributions or otherwise benefit from the assets in the trust.

You can think of a living trust as the opposite of a testamentary trust or other types of estate trusts. These are typically made after death for the express purpose of distributing assets after one passes away.

You can store all kinds of different assets in a living trust, including:

- Liquid capital or cash

- Life insurance policies

- Stocks and bond certificates

- Deeds to real estate

- Ownership deeds for other properties

Is a Living Trust the Same as a Will?

No. A living trust takes effect as soon as it is set up while the grantor is living. A will, in contrast, only kicks in when the will's creator passes away.

Furthermore, a living trust can be more beneficial than a standard will. That’s because the assets within the trust don’t necessarily have to go through the probate process. The probate process is lengthy, costly, and potentially harmful to the family because it makes all the assets within the probate process a matter of public record.

Therefore, if you want to pass on your assets or wealth to your descendants without compromising their privacy, a living trust could be just what you need.

Living trusts can still take effect when the grantor dies or otherwise becomes incapacitated; if the trust is set up properly and has the right documentation, the trust administrator/trustee will know exactly what to do and what steps to take to ensure the living trust continues to be run according to the wishes of the grantor.

What’s an Irrevocable Trust?

An irrevocable trust is a trust that can't be modified or changed after it is finalized, with two exceptions:

- Under court orders (and only in some circumstances)

- If all the beneficiaries of the trust agreed with a proposed change (again, only in some circumstances)

But for the most part, an irrevocable trust is one that can’t be changed at all. For instance, if you set up an irrevocable trust as the grantor, but then you change your mind about a beneficiary, you won’t be able to simply add someone’s name to the beneficiary list for the trust.

You can contrast irrevocable trusts with revocable trusts. As you might guess, a revocable trust can be changed or modified by the grantor and other parties after it is set up.

So, with the above example, if you create a revocable trust and want to put another beneficiary on the list, you can easily do that with the assistance of your attorney.

What’s an Irrevocable Living Trust?

Now, let's combine both concepts. An irrevocable living trust is a living trust that can’t be changed after it is fully set up.

More broadly, you as the grantor give up all ability to do anything with the trust once you create an irrevocable living trust. You can’t terminate it, cancel it, add beneficiaries, change the trust terms, etc.

These instruments are much less flexible compared to any type of revocable trust, which makes them less popular choices for estate planning (while the grantor is still alive). However, the unchangeability of an irrevocable living trust is also its biggest advantage in terms of security and asset protection.

When you transfer assets into an irrevocable living trust, you don't control the assets and no longer have any say in how they are managed. The trustee or trust administrator is the only entity responsible for managing or distributing the assets in the trust.

Indeed, there are lots of situations where an irrevocable living trust could be just what you need. Here are a few examples:

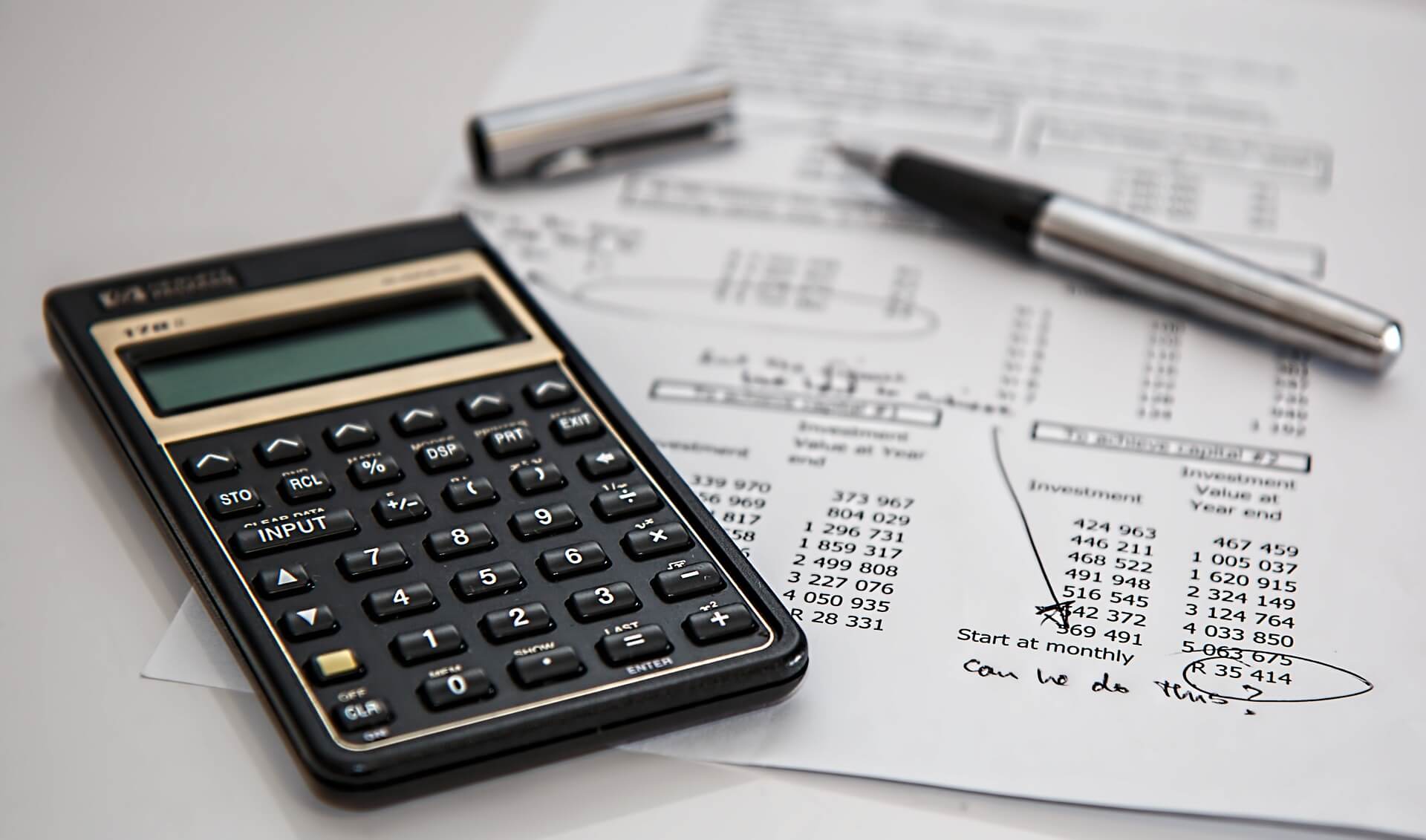

- You want to minimize estate taxes. Certain irrevocable trusts can help you eliminate or reduce estate taxes if they are set up properly, although this heavily depends on your home jurisdiction, the assets stored within the trust, etc.

- Protecting the Medicaid eligibility of beneficiaries. If you make your trust irrevocable, beneficiaries of the trust aren’t as likely to have their Medicaid and other government program eligibility levels potentially compromised by the trust

- Asset protection. With an irrevocable asset protection trust, any assets you store within the trust vehicle are fully out of your hands. Therefore, even if a creditor or court demands that you pay a bill or damages with the assets in the trust, you can legally say, “Sorry! I can’t do that.”

It’s for this reason that asset protection irrevocable trusts are very popular vehicles for high-net-worth individuals ranging from business owners to doctors and more

Note that asset protection trusts are (almost) always irrevocable by definition. If you set up an asset protection trust and it is revocable, nothing at all stops a judge or creditor from demanding that you change the trust or take possession of the assets within to pay down the debt/some other expense.

Core Differences Between Irrevocable vs. Revocable Living Trusts

As noted above, the big difference between an irrevocable and a revocable living trust is whether or not the trust can be changed by you, the grantor. If the trust can be changed, it’s revocable. If it can’t, it’s irrevocable.

It’s up to you to determine whether the flexibility of a revocable living trust is worth the lower security. It all depends on your goals and personal needs. When you work with legal experts at Dominion, we’ll help you determine:

- What your goals are for your estate and the assets you wish to protect. Do you just want to set them up so they are distributed properly to your beneficiaries, or are you concerned about protecting your estate from lawsuits, creditors, ex-spouses, and other potential threats?

- Where you want your trust to be set up. A trust set up in your home jurisdiction will be more accessible compared to a trust set up in an offshore jurisdiction, like a foreign country. However, offshore trusts are more secure since they operate under different rules and case precedents by definition

These are big questions, and they can impact the overall direction of your asset protection strategy. That’s why it’s important to get in contact with Dominion at the earliest opportunity if you want to maximize your legal defenses against future risks.

Get in Touch with Dominion Today

A carefully drafted, properly set up irrevocable living trust might be perfect for your short and long-term needs. At Dominion, we specialize in creating durable asset protection trusts that you can benefit from while simultaneously securing your wealth against legal attacks and aggressive creditors.

In fact, our resilient asset protection trusts are the best in the business, capable of keeping your estate safe and sound while growing its wealth through savvy investments and smart tax reduction strategies. Don’t wait – get started learning about your options for irrevocable living trusts with Dominion today.

.jpg)